The Ultimate Guide To How To Obtain Bankruptcy Discharge Letter

Lawyer's are not needed to keep insolvency filings."Free Personal Bankruptcy Documents"A. All Firm as well as Organization Info, may be gotten by calling the U.S.

A. Bankruptcy records insolvency to be kept indefinitely maintained 2015Till Regulations have actually now transformed to keep insolvency documents for only 20 years.

Examine This Report about How To Get Copy Of Bankruptcy Discharge Papers

If you filed personal bankruptcy in 2004 or prior, your records are restricted, and might not be readily available to get electronically. Call (800) 988-2448 to inspect the accessibility prior to ordering your records, if this applies to you. The documents might be offered with NARA - obtaining copy of bankruptcy discharge papers.(a government company) We do not function in conjunction with NARA or any one of its reps.

U (how to obtain bankruptcy discharge letter).S. Records fee's to aid in the retrieval process of obtaining personal bankruptcy paperwork from NARA, depends upon the time involved and also cost involved for united state Records, plus NARA's fees The Docket is a register of general information throughout the personal bankruptcy. Such as condition, instance number, declaring and also discharges days, Lawyer & Trustee information.

Should you maintain or throw your documents? Photo Resource: Flickr CC User Camilo Rueda Lopez It seems like life teems with documents we do not need spam, receipts for points we won't return, institution papers, paycheck stubs. For a culture that's trending toward paperless, we've obtained a long method to go.

How Do You Get A Copy Of Your Bankruptcy Discharge Papers for Beginners

If you're late paying the tax, keep the return two years from the date you paid or 3 from when you filed (whichever is later). When it comes to receipts, if there's a service warranty, maintain the receipt until the service warranty goes out. Otherwise, for anything you may need to reclaim, just keep the invoice till the return duration is up.

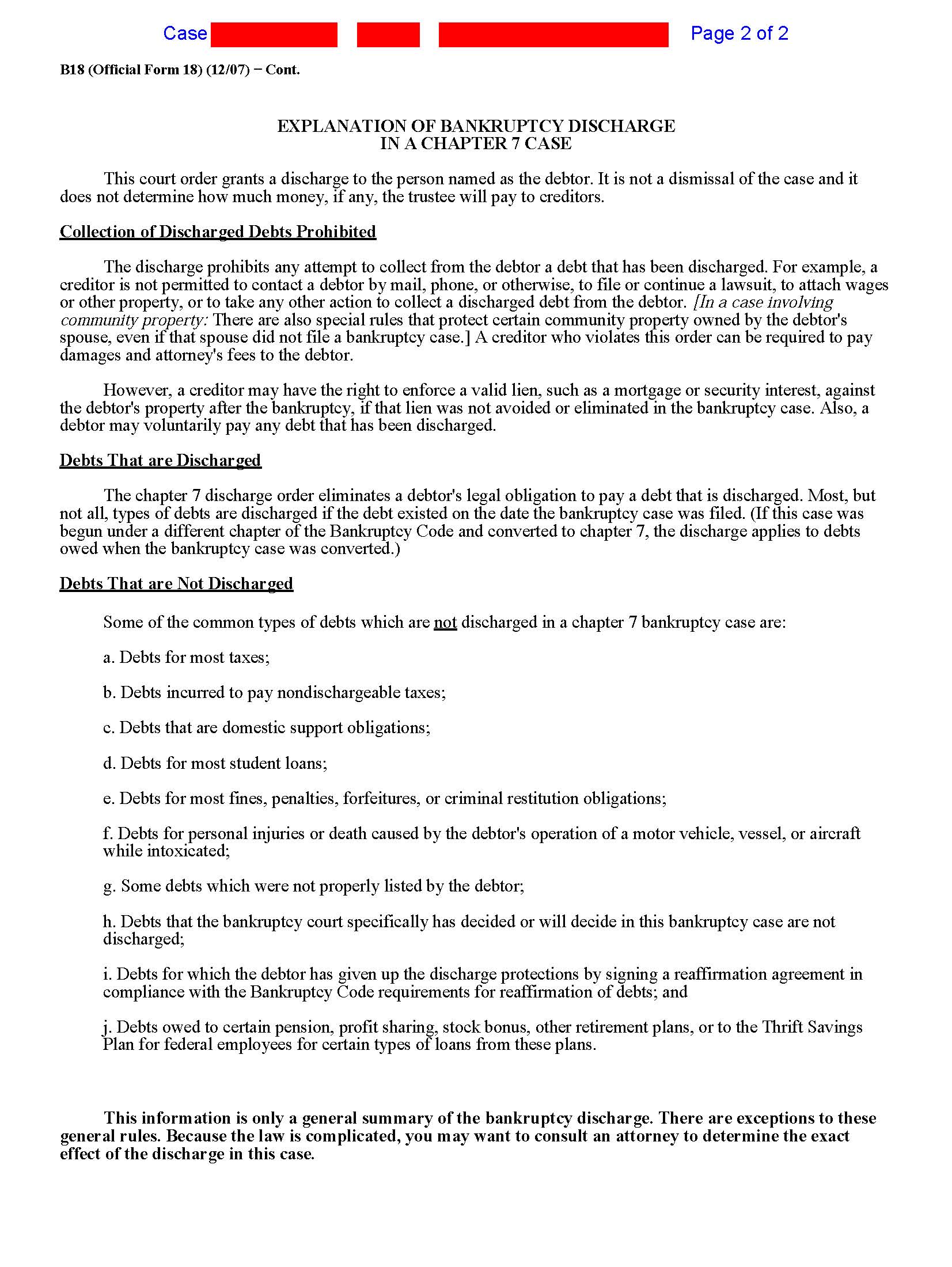

Even though your insolvency request, documents, and discharge look like monetary files that could fall under the same timeline as your tax docs, they are NOT. They are much more vital and also need to be kept forever. Financial institutions may come back and attempt to collect on a debt that became part of the bankruptcy.

Also, lenders liquidate uncollectable bill in portions of thousands (or numerous thousands) of accounts. Uncollectable loan purchasers are commonly aggressive and unscrupulous, and also having your personal bankruptcy files on-hand can be the fastest means to close them down as well as maintain old items from popping back up on your credit scores record.

How Do You Get A Copy Of Your Bankruptcy Discharge Papers Things To Know Before You Get This

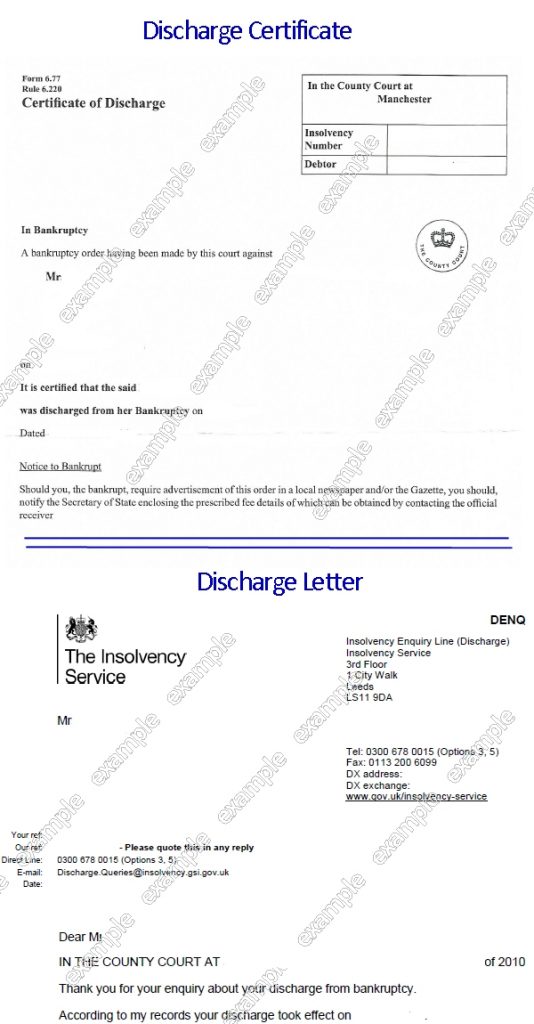

Having accredited duplicates of your documentation can stop a delay in your licensure. The short solution? Every one of them. Obtaining copies of your personal bankruptcy records from your lawyer can take some time, especially if your instance is older and also the duplicates are archived off-site. Obtaining bankruptcy documents from the Federal courts can be expensive and also taxing also.

These are the records you require to maintain: Credit scores counseling certifications (both pre-filing and pre-discharge training courses) Bills for court declaring charges Insolvency request, supporting schedules, and also displays Statements, disclosures, and also affirmations Sending by mail listing of financial institutions Evidence of earnings and social security evidence filed with request Electronic declaring declaration (if filed electronically and also most cases are) Suggests calculation (if required) and also sustaining docs Notices from the insolvency court (and also your lawyer or Trustee) Last insolvency discharge This is web pages and also web pages of info (how to obtain bankruptcy discharge letter).

Get a box or large envelope and put them all within. Put them in a secure place, also like where you maintain your will certainly as well as various other crucial monetary papers as well as just leave them there.

Our How Do You Get A Copy Of Your Bankruptcy Discharge Papers PDFs

To locate out even more concerning the advantages of North Carolina personal bankruptcy, contact the Regulation Offices of John T. Orcutt. Call +1 -919 -646 -2654 for a complimentary no-obligation North Carolina bankruptcy assessment at one of our areas in Raleigh, Durham, Fayetteville, Wilson, Greensboro, Garner or Wilmington. Obtain the economic assurance you are entitled to (chapter 13 discharge papers).

A released financial obligation literally goes away. It's no more collectible. The lender has to write it off. Financial obligations that are most likely to be released in a personal bankruptcy proceeding consist of bank card debts, clinical expenses, some suit judgments, individual financings, obligations under a lease or other agreement, and also various other unsecured debts. That may appear too good to be real, and also there are certainly some downsides.

You can't merely ask the personal bankruptcy court to discharge your financial obligations due to the fact that you don't want to pay them. You have to complete all of the demands for your bankruptcy case to obtain a discharge (how do i get a copy of bankruptcy discharge papers).

The Definitive Guide to Obtaining Copy Of Bankruptcy Discharge Papers

Bankruptcy Trustee, and also the trustee's attorney. The trustee personally manages your insolvency situation - chapter 13 discharge papers. This order consists of notification that creditors ought to take no further activities to gather on the financial obligations, or they'll encounter penalty for contempt. Maintain a duplicate of your order of discharge together with all your various other insolvency documentation.

You can submit a motion with the insolvency court to have your situation resumed if any lender tries to collect a discharged debt from you. The creditor can be fined if the court determines that it went against the discharge order. You can try merely sending out a duplicate of your order of discharge to quit any collection task, and afterwards talk to a bankruptcy lawyer regarding taking lawsuit if that doesn't work.

The trustee will liquidate your nonexempt properties and also split the earnings among your creditors in a Phase 7 personal bankruptcy. Any kind of debt that stays will certainly be released or eliminated. You'll become part of a repayment strategy over three to five years that repays all or a lot of your financial debts if you submit for Phase 13 security.